Indian economy at crossroads

Amal was recently working as Assistant Professor (Economics) in Jain University Kochi. Now he is preparing for civil services exam. He is a post-graduate in Economics from Pondicherry Central University.

[responsivevoice_button voice=”US English Male” buttontext=”Read out this Theel for me”]

There is a broad consensus among economists that the Indian economy was already slowing down well before the COVID-19 pandemic. The lockdown has crippled the economy, and the chances for an early revival seems remote. Expectations soared high with the Prime Minister’s announcement of an Rs. 20 lakh crore fiscal stimulus package. When the details were spelt out by the Finance Minister, it was clear that the government was focussed on boosting the supply-side of the economy by ensuring adequate capital availability on easy terms. This has forced us to question whether the government has got its priorities right in its quest for the revival of the economy.

Emerging Issues

Before we analyse the nature of the fiscal stimulus, we need to understand the issues confronting the economy. First and most important, the loss of livelihoods. A CMIE report published recently estimates that 27 million youth in the age group of 20-30 years lost their job in April 2020. Second, the return of migrant labourers to the rural areas creates a host of issues. Added to this, the return of migrants from abroad, especially from the middle-east can make things murkier. Third, an ailing financial sector confronted by mounting non-performing assets and liquidity crunch in NBFCs and Mutual Funds. Fourth, the falling tax collections, both direct and indirect tax reduces the elbow room of the government to spend its way out of the crisis. The state governments which are at the forefront of the battle are finding their coffers drying up. This can severely affect the capacity of the states to deal with the pandemic. Fifth, the supply chains in the economy have broken down as a result of the lockdown. Structural issues like agricultural marketing, land and labour markets still persist. It is in the light of these issues that we must analyse the stimulus measures of the government and the RBI.

Distinct Patterns

RBI was forced to enter the fray early on with very limited ammunition to instil confidence in the economy. RBI’s measures included cutting repo rates, a moratorium on loan EMIs, channelling liquidity into NBFCs and MFIs, reducing statutory reserve requirements for banks and so on. These measures depend on banks to borrow money from the RBI to lend to the distressed sectors. Given the rising Non Performing Assets (NPAs) and the level of risk aversion in this sector, these measures are unlikely to have the desired impact. Monetary policy is generally more effective in controlling inflation rather than stimulating an economy which is in a slump. RBI should try to quicken the process of resolution of bad loans and instil a sense of confidence in the financial sector. The process is easier said than done. Quicker resolution of bad loans can possibly reduce the risk aversion in the industry and induce banks to lend more. Liquidity infusion measures taken by the RBI and the government can achieve the desired results only if the problems of bad loans are sorted out.

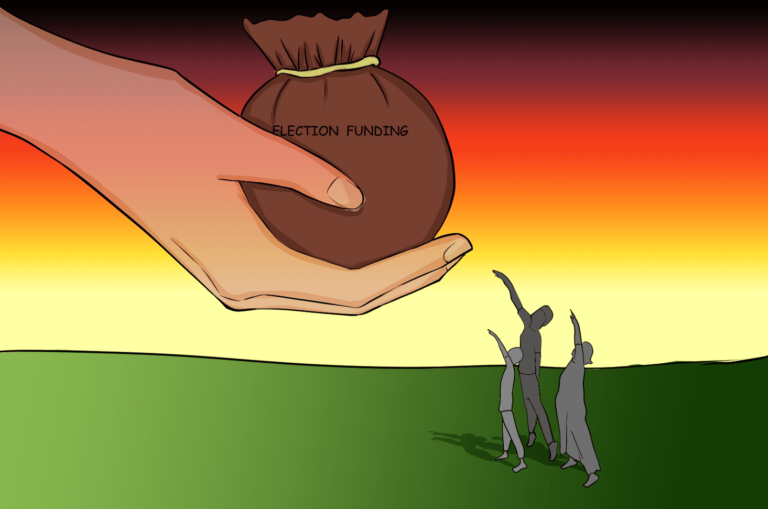

The stimulus package of the Union Government is centred on the idea that flushing the economy with liquidity will lead to a recovery in supply and help get back on the path to recovery. An analysis of the package shows some distinct patterns in the government’s approach. And that is to boost the availability of capital on easy terms, minimum allocation to wage and income support schemes, allowing increased private sector participation and most importantly to keep the damage to fiscal deficit minimum. A few measures like increasing the allocation for MGNREGA by Rs. 40000 crores and increasing the borrowing limits of the states though laudable are not enough to revive the demand in the economy. The fiscal impact of the reforms is estimated by economists to be around 2-3% of the GDP, which is grossly inadequate to counter an unprecedented situation like this.

Importance of Demand

A continuation of the government’s policy of tightening purse strings is evident even in the much celebrated ’20 lakh crore’ stimulus package. The government’s emphasis on supply seems to be based on economic thought that “Supply creates its own demand” (Say’s Law). This seems a flawed strategy to pursue given the declining incomes and rising unemployment. People may not spend like in normal times. It is here that the government has to step in and ensure that demand is not falling. The point is not to belittle the supply-side measures taken by the government but to draw attention to the lack of demand-side measures.

When we try to address the issue of demand, we need to look at the expenditure components of national income accounts: private final consumption expenditure, government final consumption expenditure, gross fixed capital formation private and public and exports. Private final consumption expenditure has been exhibiting weakness. This is not an autonomous element as it is dependent on income. Therefore, the three independent elements that can be used to revive the demand are government consumption expenditure, government investment expenditure and exports. There is very little hope about using exports as a lever for reviving demand considering the health of the global economy. Thus the mantle of reviving the demand falls upon the government expenditure.

The importance of reviving demand can be explained with the use of a concept called the ‘multiplier effect’ introduced by an economist named John Maynard Keynes whose ideas played a crucial role in the revival of western economies after The Great Depression. The argument is that an increase in government spending becomes income for consumers. Some of this income is saved, and some are spent. The cycle is then repeated, resulting in the initial increase in expenditure being multiplied. Therefore lower government expenditure implies that lower direct and indirect demand is generated through multiplier effects.

The government’s reluctance to spend stems from its obsession with the fiscal deficit. A lower government expenditure further slows the economy and leads to a fall in tax collections which further restricts the ability of the government to spend. This forces the government to procrastinate the transfer of funds to states, in turn, compromising the ability to deal with the fallout of the lockdown. Allocation to crucial areas like agriculture, education, women empowerment etc. are likely to take a beating.

Way Forward

The government must get over its obsession with fiscal deficit at least until the economy gets back to normalcy. Opponents may point out the inflationary effects of fiscal deficit and the experience India had in the aftermath of the 2008 Global Economic crisis. But these are abnormal times calling for abnormal policy decisions. Ensuring that income reaches the hands of the poor is the primary step that the government must take. Adopting income transfers for the rest of the year can help a great deal in mitigating the effects of the lockdown. Simultaneously, ensuring universal access to free food grains can take the burden off the poor. Increased allocation for MGNREGS coupled with the introduction of a similar programme in urban areas (say MGNUEGS) can help in income generation as well as asset creation in the economy. Measures to ensure that supply chains are less dependent on China can do India good in the long run. Over the medium-term, the government must reduce the revenue expenditure components wherever possible and shift it to the capital expenditure account. Strategies to boost consumption like across the board slashing of GST rates can be thought of. The country is paying the price for neglecting investment in health and education over many decades. It may be hoped that this pandemic induces a change for the positive in how the government views sectors like health and education.

It may be difficult to satisfy all in these difficult times, but it has to be pointed out that the government has taken a gamble by not borrowing more and boosting demand.

References:

- “27 million youth in age group of 20-30 years lost jobs in April: CMIE”: -Economic Times- May 13, 2020

- “Govt’s fiscal stance pushing economy into further decline”-Business Line-June16, 2020

- “Stimulus package does not do much to boost consumption in the short term: SBI Ecowrap”- Business Line, May 18, 2020

Featured Image Credits: Wikimedia

Excellent in-depth analysis & good solutions too

Very good analysis of Indian economy

Very good analysis..